Like with gold, the new letter X is short for gold and silver, and PT ‘s the abbreviation for Precious metal. The brand new symbols XPTUSD, XPTEUR, XPTGBP, XPTAUD, and XPTCHF are used for trading platinum against various currencies. Buyers is also profit from rates movement of the precious metal by the exchange the newest silver icon in the foreign exchange market. To start exchange silver inside the forex, one merely needs to register with an established broker and you may, after membership verification, open a purchase otherwise promote condition on the silver icon. Simply because of its rareness, inherent value, and you will greater programs in various markets, along with jewelry, electronics, and scientific circles, silver has always drawn traders. Rates action from silver are influenced by individuals items, as well as rising prices rates, rates, global request, geopolitical situations, as well as likewise have and you will demand inside bodily locations.

CFD is a common phrase on the stock trading community, and you will a highly common monetary instrument. You can search for the metal partners you need to change https://beautydivas.nl/comprehensive-writeup-on-instantaneous-i400-proair-v-8-5-advanced-crypto-exchange-system/ once your deposit might have been canned. While the Intense Pass on Account charges pass on from one.8 pips to the XAG/USD and you will 0.six pips to your XAU/USD, the standard Penny (commission-free) fees step three.six and you will 1.9 pips, respectively, during these devices. Furthermore, Platinum and you will Palladium offer novel potential due to their rareness and you can commercial software. Find the difference in all of our membership types and the listing of professionals, and business-stages execution.

Why Trading Gold and silver that have easyMarkets?

Various types of purchases come to the best metal trading networks. And pick/sell and you may industry/limitation sales, this should tend to be get-cash which will help prevent-losings sales. JustMarkets are a well-identified Seychelles-dependent forex and you may CFD broker that gives material buyers an alternative advantage in the competitive areas. Which representative now offers multiple account versions, of Basic Cent to Brutal Spread, making sure the buyers receive personalize-produced choices. We conducted alive screening playing with a basic membership having Exness, which offers percentage-100 percent free exchange and you will floating spreads carrying out in the 0.dos pips. I came across their advances to your precious metals getting rather lower than the industry mediocre.

- In addition, easyMarkets also offers a person-friendly program to possess buyers to remain associated with areas around the nation at the same time.

- Sure, numerous agents provide micro otherwise small profile that have lower minimal put criteria.

- Competent people typically browse that it detailed land by merging technology study which have a serious focus on business belief.

- Metal investors vary from individual buyers, hedge fund, banks, or any other loan providers.

- Additionally, Tickmill’s Pro and you may VIP profile are percentage-founded, having a great $4 payment for each and every package and thin spreads out of 0.0 pips to the major tools for example EUR/USD.

Ft precious metals are generally cost below gold and silver because of the abundance in the wild and reactivity to the environment. Including, copper is employed in the creation of cables and you can wires owed in order to the high electronic conductivity, when you are nickel is employed in the chemical compounds globe for the corrosion opposition. However, the new proportion began narrowing inside 2020, appearing a rise in the cost of gold. They may trading silver ultimately by buying silver futures, alternatives, otherwise committing to ETFs or shared finance. Speculating on the spot cost of silver which have CFDs is even all the rage. Trade CFDs on the Gold and other place gold and silver having HFM and you may get a competitive border from the active gold and silver business.

You can trade antique brings and you can ETFs, futures, CFDs, and you can fx through this dismiss broker to the a commission-free base, diversifying your portfolio from the a low cost. It ensures brief execution out of purchases on the precious metals, offering the finest market prices and you will fewer chances of slippage occurring. The fresh representative is actually a reliable agent registered by reliable associations such the new FSC and you can FCA, guaranteeing the protection away from traders’ currency. Pepperstone offers diverse trading options for precious metals for example Silver, Silver, Rare metal, and Palladium, providing them up against biggest currencies such as the You Money. Other popularly traded steel certainly commodities traders, silver has been even more put as the a form of hedging up against volatility in the stock exchange. Jitan Solanki is actually a specialist individual, field analyst, and you will teacher.

Experience-Driven Development

More well-known and you can replaced high-worth precious metals is gold, silver, rare metal, and palladium. But there are many, including beryllium, ruthenium, osmium, rhenium, iridium, and you can rhodium. FXTM simply also provides gold-and-silver trade, which means this article will be targeting those two precious metals specifically.

A metal’s chemicals composition and you will actual characteristics are just what identify him or her from one another. They’re mined while the ores and refined, but it’s tough to achieve 100% purity. Such as, gold has been a form of money and employed by jewellery makers for hundreds of years. They stays unchanged, it could be recycled, and you may central banks hold it within supplies. From the 10% can be used within the design, such as electronic devices, aeronautical circuitry, and you may drug.

- You need to use futures otherwise options contracts to take action in the metal change.

- Other metals such as head, tan, tin, iron, mercury, nickel, uranium, titanium, chromium, aluminum and several someone else have been discovered later.

- Metals are valued due to their rarity, resistance to rust and you can oxidation, and you may capacity to look after their appearance over the years.

- With over twenty five years of experience, the newest OANDA Category also offers best products, strong systems and transparent costs.

- Take advantage of prompt execution without requotes with this MetaTrader 4 on the internet trade system.

Silver is one of preferred since it is sensed a safe-retreat investment in order to hedge against money devaluation or high rising cost of living. As well, silver has been utilized to help you hedge against currency industry volatility. People relocate to urban areas and eat much more issues, along with vehicles demanding precious metals for example gold. Even after inhabitants expands, the fresh relative source of gold and silver coins will not increase. People would be to wait for fashion that show financial data recovery and you may improved industrial hobby.

Considering their choices, you are going to sign up for a merchant account that have EF International Ltd, that’s authorised and you may controlled from the Economic Services Expert out of Seychelles (License Amount SD056). Take advantage of very-lowest fee costs and develops which go as low as zero to have Silver/All of us Dollars (XAUUSD). The platform you choose to trading steel on the net is certainly one of the first decisions you should create. You might be informed in the event the a major steel pair breaches a key household range. Alternatively, the platform you are going to notify you whenever a narrative holiday breaks that might affect the cost of a great currency partners later.

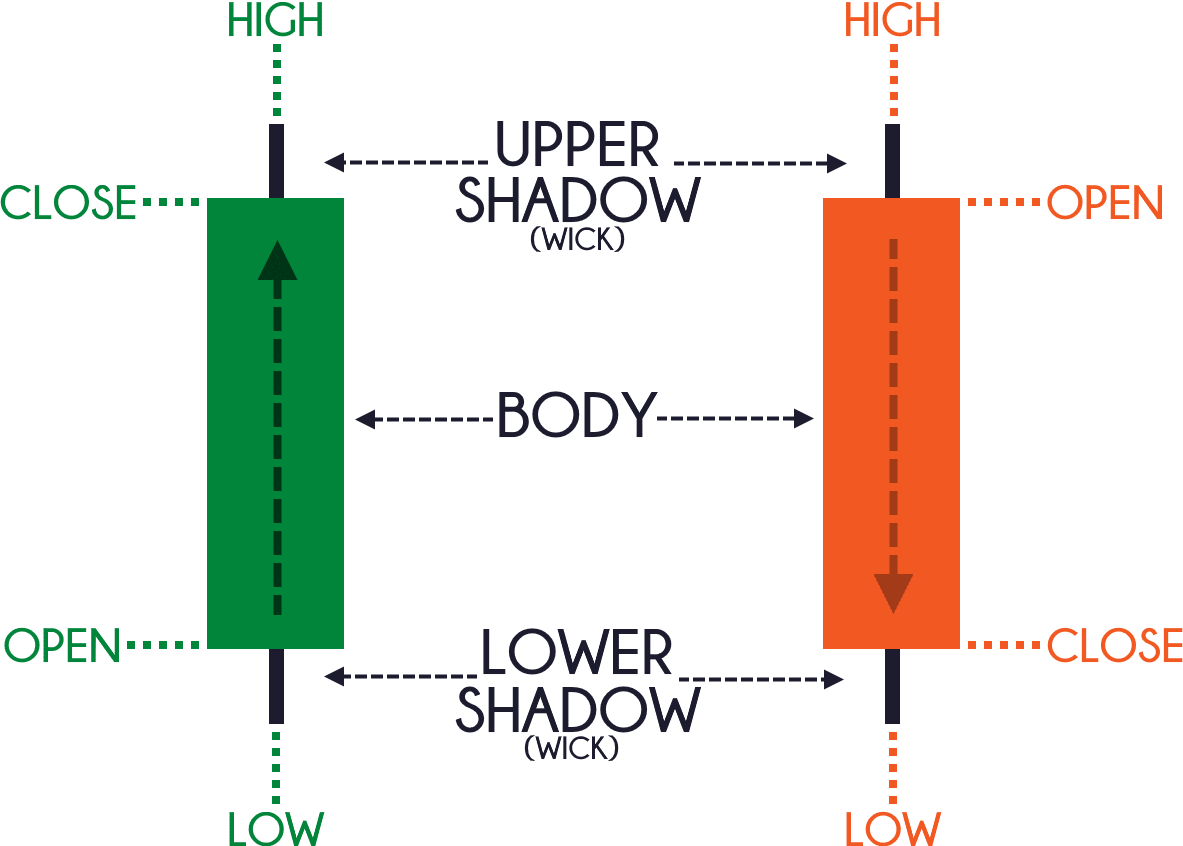

When traders be involved in precious metals trade, no matter what form of material, novel procedures may benefit traders. Below, we’ll defense several of the most well-known steps have a tendency to put inside the precious metals trade. With material CFDs, you just imagine in the industry’s speed advice as opposed to owning the underlying advantage. It presents significant advantages as possible exchange long and short and you will make the most of ascending and you will dropping places.

These authorities also require agents to join a payment scheme, and that protects consumer opportunities if your representative goes broke. To ensure an agent’s regulating adherence, opinion its court terminology and look for the relevant nation’s regulating register. The live percentage try exhibited the brand new bequeath to the gold put CFD bargain averaged 2.9 pips, a bit much better than the average to have a percentage-100 percent free precious metals representative. BlackBull brings an extraordinary list of segments to own top-notch traders.

Whenever trading metals, it’s vital to remember to carry out deals having a great controlled agent authorized and you may authorized by an authorities monetary authority. The brand new Plus500 Academy provides more helpful devices featuring its reports and you can field understanding website and you can an excellent set of educational articles and you may video clips layer info and methods to own trading. The fresh cellular exchange software alone must also just be online away from official application areas such as Fruit Software Shop and you may Yahoo Play Shop.

As the mentioned before, precious metals trading will likely be challenging rather than generous financing. Thus, if you are searching to-day change, you are centering on really small income. Hence, you should always consider what charge was charged when change material on your own chose website. Particular actions derive from the belief one to costs have a tendency to return on their normal profile once going excessive otherwise as well reduced. This really is useful in the brand new material business, in which rates vary drastically due to governmental points or unforeseen also provide shifts.